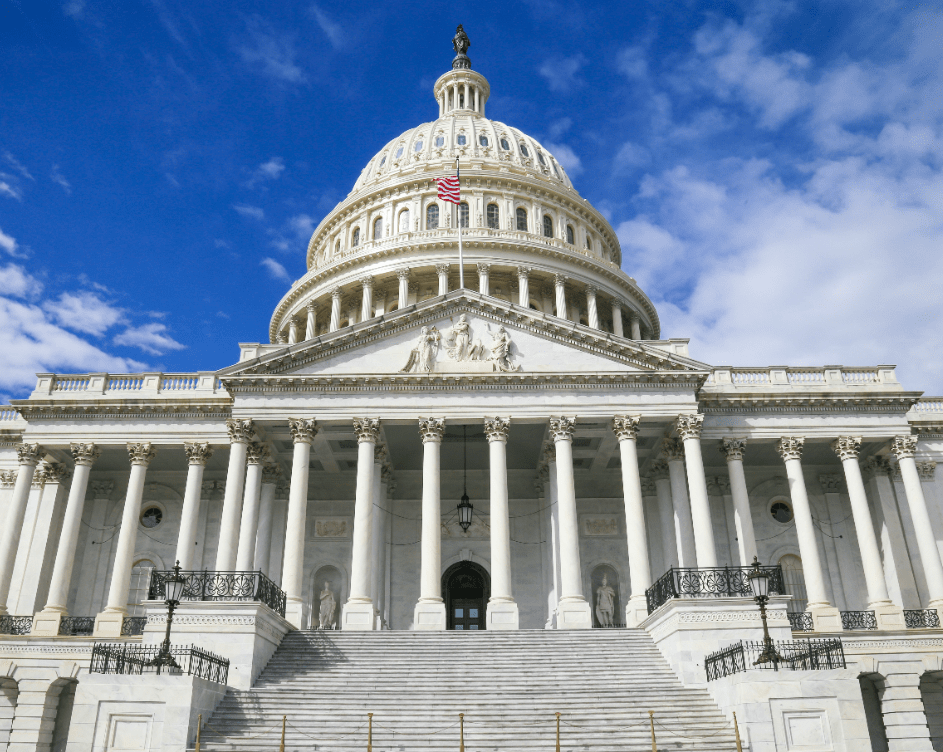

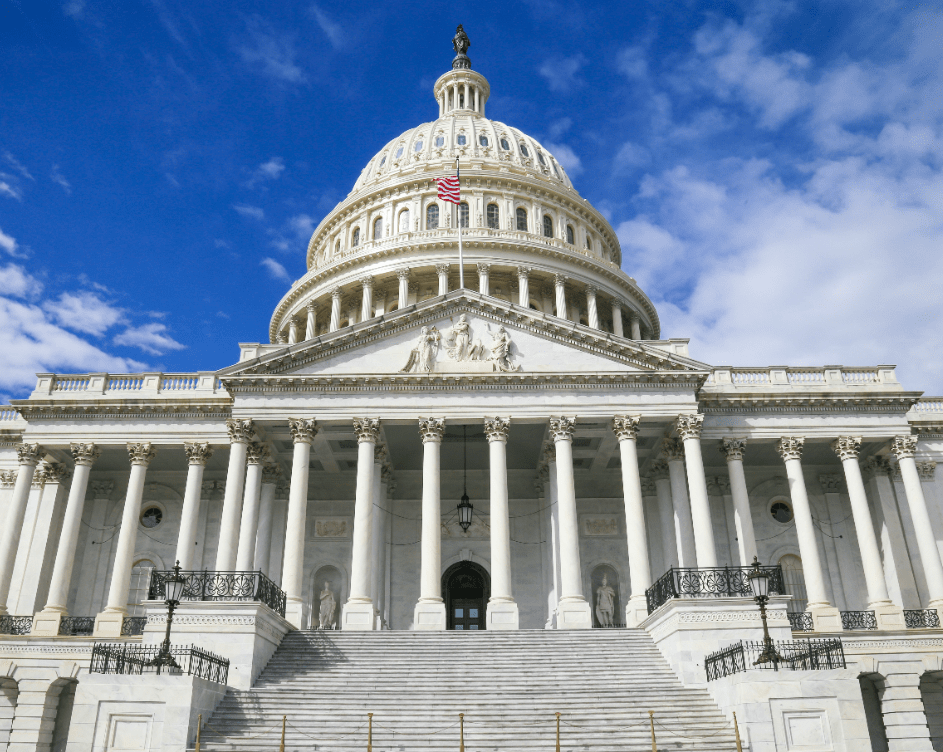

Congress has finally reached an agreement on a new financial aid package, which includes stimulus checks to many Americans. The total package in approximately $900 billion, and is designed to help American businesses and the general population weather the economic storm that is Coroavirus.

As we reported last week, the expected amount of $600 will hold true.

Like the first bill (CARES ACT), it appears the $600 payments will be released to taxpayers with earnings up to $75,000 (single) or $150,000 (married filing joint) based on their most recent tax filing. For most, this would be their 2019 tax year. In other words, if you received a check from the first bill, you should expect to receive something from this one.

An additional $600 will be received for each dependent of the taxpayer who is under the age of 17.

The aid package also contains $300/week in additional unemployment benefits. This could be rolled out as early as December 27th and continue for 11 weeks.

Other items of note in the bill are an extension of one month for a moratorium on eviction that was set to expire at the end of the year.

Another round of $275 billion in Paycheck Protection Program (PPP) funding is expected to aid small businesses, about $80 billion for schools, $13 billion in food stamps, and $20 billion for vaccine distribution is also contained in the bill.

One of the biggest aspects of the bill for small businesses who previously took advantage of the last PPP fund is the ability to deduct the expenses that these funds were used for on their tax returns. Previously, the IRS had ruled that, per their interpretation, any PPP funds used for qualified business expenses would essentially negate the deductibility of those expenses. This is a massive windfall for those who took out PPP funds.

As of right now, we are still not sure on any additional specifics as the actual bill has yet to be released and has not officially been passed. Congress is expected to pass the bill today.

Follow Campbell Financial Services for more updates on all things tax and finance.

Leave A Comment