Have questions on your financial future?

We have answers.

How We Help You

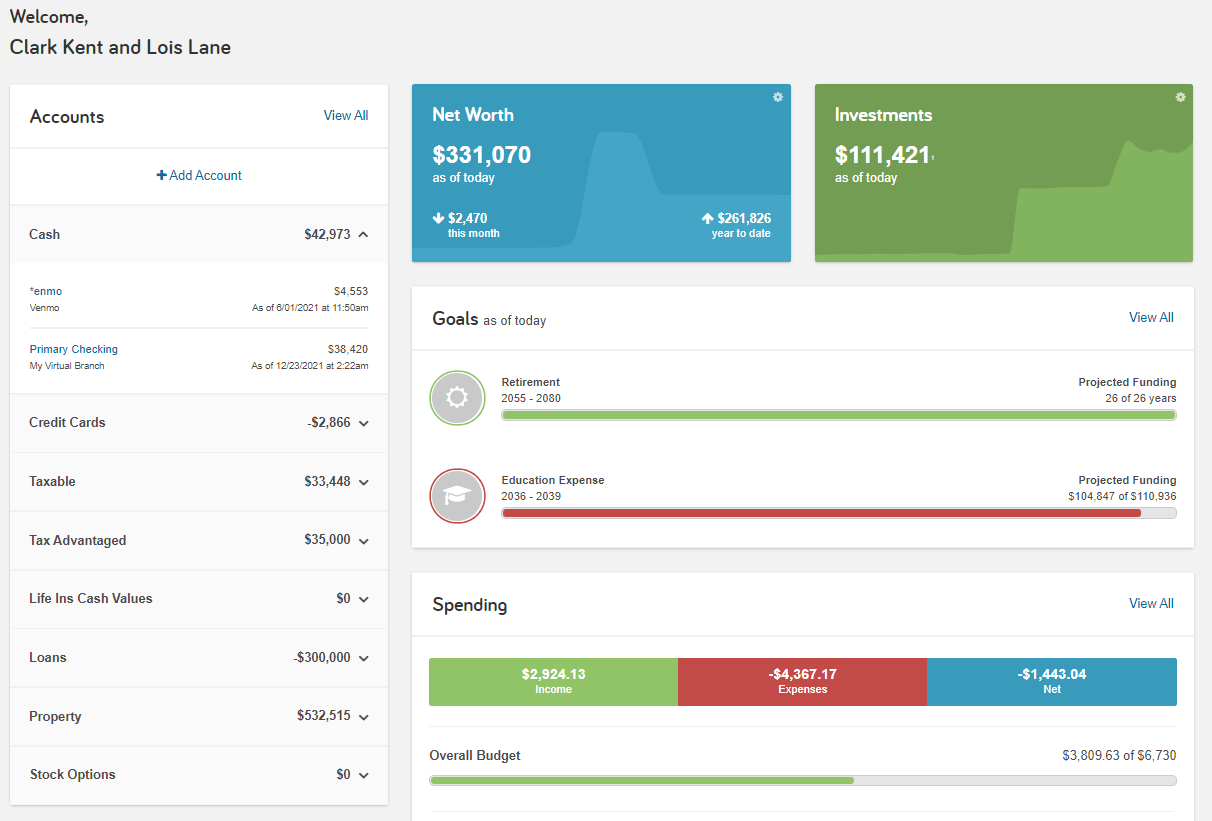

Through a methodical approach, we will help you find and improve your financial weak spots and create financial security through careful planning and investment management. Advisory services are far more than just investment and portfolio creation.

We’ll help you organize your financial world, understand your goals, and create a plan that balances living for today while helping to secure a bright future for tomorrow.

this is a spacer

Financial Planning Areas of Focus

(click or hover for more detail)

Your investment strategy will include topics such as:

- Asset Allocation

- Tax-Smart Investing & Planning

- Tax Loss Harvesting

- Rebalancing & Monitoring

- Market Performance and Outlook

- Risk Tolerance

We’ll build a unique portfolio for your needs, and manage it throughout the year and the years to come.

A retirement strategy of “set it and forget it” can lead to missed opportunities. We’ll work with you to determine what your ideal retirement looks like, and create a plan to help make it a reality.

- Funding your vision of retirement

- Social Security Planning

- Employer Sponsored Plans and Pensions

- Health Care & Long Term Care

- Managing Required Minimum Distributions

You’ve worked hard for what you’ve earned and accumulated. It’s important to review strategies to protect your assets. We’ll include asset protection discussions and strategies in your planning.

- Estate Planning Needs

- Utilizing Trusts

- Charitable Giving Strategies

- Gifting Strategies

- Creating a legacy

Protecting your income streams and defending against the possibility of outliving your assets is a critical part of financial planning. We’ll review topics such as:

- Life Expectancy Discussions

- Life Insurance

- Disability Insurance

- Use of Annuities

Life changes; sometimes unexpectedly. We’ll help you plan for what you’re aware of while also guiding you through the unexpected.

- Saving for College

- Savings for a house (primary, investment, or vacation)

- Savings for other goals (wedding, boat, car, etc.)

- Caring for Children or Parents

- Divorce

- Business Needs

Money (and finances in general) are simply a tool to help you live your best life. We’ll assist with money management to help you on your way to financial freedom.

- Managing Debt (Credit Cards, Student Loans, Mortgage, Auto)

- Budgeting Tactics

- Cash Flow Management

- Establishing Emergency Funds

Our Process

Test

Test

Test

Test

Why Campbell Financial Services / FAQ

What Makes Our Team Different? (Click to Read More)

-

A CPA and CFP Office

For many, taxes are their largest annual expense. It is crucial to consider the impact of taxes on your investments and financial plan. We are both a CPA and CERTIFIED FINANCIAL PLANNER firm and have a thorough understanding of the tax code and its impact on your investments and income sources. Other firms may promise to communicate with your CPA, but that leaves room for miscommunication or lost time that could negatively impact your portfolio.

-

A Multi-Generational Firm

Forty percent of financial advisors plan on retiring within the next ten years. Only six percent have a “next generation” advisor in place for a succession plan. This could leave you without a financial advisor when you need them most, or one who is unfamiliar with your personal situation and needs. As a multi-generational firm, Campbell Financial Services implements a team approach that provides the experience you can rely on, with the knowledgeable youth necessary to ensure someone is there for you and your family in future years. This can include building a relationship with your children to assist them when you are no longer guiding them. We are proud to say that our high retention rate has resulted in new advisory relationships with the adult children of our first clients from twenty-five years ago.

-

Local

We are a local family firm, which means a Campbell is always available to meet and talk. Unlike large national firms who may be difficult to reach, a live person is always at your disposal who knows you personally. This can make a big difference during times of market volatility or when immediate assistance is needed.

How Often Do You Meet With Clients? (click to read more)

While we monitor investment portfolios year round, we proactively meet with our clients three times a year. We meet during the winter, late spring, and fall. During each meeting we focus on different areas of your financial health, provide advisory services, and update your financial plan accordingly. We are available for other meetings or communication throughout the year outside of these regularly scheduled meetings.

How Are You Paid? (click to read more)

Our advisory platform is based on an asset under management (AUM) model. This is a fee only approach where our management and financial planning fee is based on a percentage of the total assets we manage. This aligns our interests with yours. If your portfolio grows, our fee incrementally grows as well. This is one of the most common ways of billing in the financial industry. This is opposed to a commission based billing model which can pose conflicts of interest.

Are You a Fiduciary? (click to read more)

We are fiduciaries. This means we must (and want to!) put your needs first. If a financial professional is not a fiduciary, there is the risk they could push product and look out for their own needs over yours. It is our opinion that no matter who you choose to work with, they should be a fiduciary.

Are You Independent (click to read more)

Yes! We do not work for any mutual fund company, insurance company, or anything of the sort. We have no quotas and run our business independently.

What Licenses Do You Carry (click to read more)

Campbell Financial Services has both the Series 7 and Series 66 securities licenses as well as being insurance licensed. This means we are not limited in the financial products available to us. It’s important to know if the professional you are working with has more limited licenses. To a hammer, everything is a nail. If you’re working with someone who is only insurance licensed, for instance, their solution will always be an insurance product. With our licenses, we are in a position to review your needs and only recommend products that make sense.

Not Quite ready to move forward? That’s okay! Feel free to review some of our free resources below or come back to our blog later. If you decide you’d like to learn more, you can schedule a free consultation at any time.

What do successful retirees have in common?

retirees

As a tax and financial advisory firm, we have become very familiar with the similar traits successful retirees share. We’ve compiled a list of the top five attributes of successful retirees.

Are You Making One of the Three Big Retirement Blunders?

This 20 minute webinar will help you avoid some of the pitfalls we see in personal finance. Specifically revolving around retirement, you’ll learn

1. How to understand your income needs throughout retirement

2. How to protect your income sources

3. And how to live your best life in retirement

Contact Us

Book an Appointment

- 1-508-747-5249

Sign up for our newsletter!

(We do not share your data with anybody, and only use it for its intended purpose)