Should Your Financial Advisor Be Doing More?

When I ask people the role of a financial advisor and what their advisor should be doing for them, I consistently get the same answer.

Investment Management.

When we meet with prospective clients who are currently working with someone else, we often find that their advisor is providing a service consisting of, you guessed it, Investment Management.

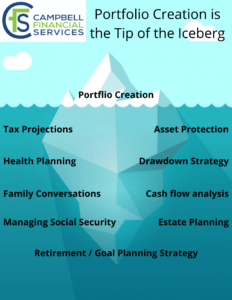

But here’s a fact that’s often overlooked (or should I say secret, but seemingly it is one and most financial “advisors” want to keep it that way): While investment management is an important part in a financial advisor’s role with their clients, it’s only one piece of a much larger scope of service that they should be providing. Investment management accounts for one third of what we should be doing for our clients as advisors.

When you ask us what a financial advisor should be doing for their clients, we would say gaining a complete understanding of their financial picture. This reaches beyond just their current assets and includes conversations around goals, fears, desires, and important relationships. We listen to those unique circumstances and create a written financial plan that shows where a client is, where they want to go, and how to get there. We then build a custom investment portfolio that works hand in hand with their plan. Beyond monitoring and managing the portfolio throughout the year, we meet to discuss life changes and update their plan. We educate on financial matters like tax effects and distribution strategies, Social Security and Medicare, Asset and Income Protection, and Legacy. Our clients gain confidence in their finances by knowing they are working with someone who understands them and has taken the time to go beyond the investments to create real strategy.

If you ask me, financial advisors who are limiting their service to investment management are doing a disservice to their clients, and they’re getting away with it because the general public is unaware that good advisors will become a truly trusted financial partner with their clients. If someone is holding themselves out as an advisor, they should be one.

How can you know you’re properly invested if you don’t know what the future holds for you? How can you have confidence in your finances if all you have is an investment portfolio that’s being managed in isolation? The answer is you can’t.

If your advisor isn’t having these conversations with you, it’s time to ask why. If you’d like to learn more about what professional financial advisory services look like, we have a downloadable guide you can find here.

Trust Campbell Financial Services with all your Tax and Financial Needs.

Contact Us

Book an Appointment

- 1-508-747-5249

Sign up for our newsletter!

(We do not share your data with anybody, and only use it for its intended purpose)

Leave A Comment