For those watching the markets recently, a common question seems to be emerging. How much lower will the markets drop, and for how long, due to the recent outbreak of Coronavirus? Unfortunately, there is no clear answer to this. This virus has had both an emotional toll on investors as well as direct economic impacts. The quarantine in Hubei province and other restrictions on travel have dramatically impacted the Chinese economy. Initially, these impacts were contained when it appeared Chinese officials were able to suppress further spread of the virus. After a brief drop in January, global stocks rallied. Since that time, new cases have risen outside of China, including 53 known cases in the United States. Those companies who trade with China are feeling an impact on supply. China accounts for 1/3 of global trade, so it is no surprise this is affecting not only China’s economy and stock market, but global markets as well. The United States is no exception.

While we can draw a direct connection to the recent decline in stock market performance to trade restrictions and lack of workers in Chinese factories and ports, this decline is being compounded by emotion. The stock market has a tendency to feed on fear, and there is seemingly a herd mentality right now. Mass decisions based on emotion can have the ability to produce market swings, both up and down, for apparently no reason. This “fear factor” Is harder to measure but does appear to be involved in the recent market decline. The best way for me to describe this phenomenon is to directly quote Martin Landry of the Portfolio Management Group at Avantax Wealth Management who I believe summarized the concept nicely. He explains, “When investors imitate one another, or rely on the same information cascades, market efficiency is lost. The actions of some market players induce others to take the same course of action (buy or sell) based on the same signals from the environment without consideration that others are doing the same. Most important, they might be ignoring clear signals that it’s in their best interests to refrain from taking the same action as a large group of others.1”

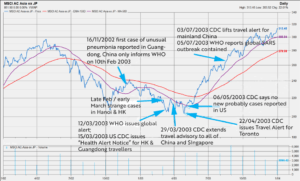

While the “fear factor” is hard to influence, there are reasons to remain positive. For one, the market has historically always bounced back2. Citing a more specific case study, Legg Mason compared the recent Coronavirus outbreak and its effect on the markets to that of the SARS outbreak in 2003. This chart was grabbed from their study, and the big takeaway is that once evidence of a peak in new outbreaks has been seen, a similar pattern of market rally could follow.3

We are seeing a similar timeline now, from the first outbreak, to global travel restrictions, to World Health Organization guidance. There is an old saying, “history repeats itself” and if that holds true, there is great reason to remain positive.

Some Final Thoughts:

- It is important not to make decisions based on emotion. Do your best to look at only the facts. While this can be hard to do, it is important in any major decision you make, especially financial ones.

- Don’t Jump to conclusions. Quick decision that are not given the proper amount of thought can be devastating.

- Remember that the market has always bounced back. The best course of action is usually to stay the course. Selling low and buying high is exactly what you don’t want to do. Trying to time the market usually ends poorly.

- Remember you can call us to discuss your discomfort with what is happening and seek specific guidance for you as an individual. That is what we are here for.

Referances

- “As the Coronavirus Goes Global, it’s Not Time for a Panic by Martin E. Landry, CFA

- Dow Jones Historical Trends from MacroTrends https://www.macrotrends.net/1319/dow-jones-100-year-historical-chart

- Legg Mason Global Asset Management https://www.leggmason.com/en-us/insights/investment-insights/mc-history-tells-investors-about-coronavius.html

Contact Us

Book an Appointment

- 1-508-747-5249

Sign up for our newsletter!

(We do not share your data with anybody, and only use it for its intended purpose)

Leave A Comment