Blog

Why Your Tax Refund May Be Different Than Last Year

For the most part, tax law for individuals has been consistent from 2021-2022. This is a huge sigh of relief for us tax preparers. The

2023 Market Update

A Look Back at 2022 2022 may be a year we will all quickly try to forget from a financial perspective. To describe it as

Is Your Retirement Plan More Trick Than Treat

Not knowing if your retirement plan and investment strategy is adequate could be scarier than Halloween. While ignoring deficiencies or just guessing that you’ll be okay

An Update To Charitable Donation Tax Law

For many years, charitable donations as a tax right off have only been available to those who itemize their deductions. Those who take the

Is Venmo Sending Tax Documents to Users of the App?

First off, what’s Venmo? For those who aren’t familiar, it’s a popular financial app that allows for convenient cash exchange between friends and family.

January 2022 Market Update

Wow! What a difference a year makes. After the S&P finished up 27% for calendar 2021, 2022 has been off to a rocky start.

Did You Receive a Third Stimulus Payment?

There was a third economic stimulus payment sent out in 2021 for those who were eligible to receive it. When it comes time to

Choosing a Business Entity Type

Intro A common question for those who are going into business for themselves, or even those who have been self-employed for a while, is

How Estimated Tax Payments Work

As a business owner, you have a lot of responsibility. On top of running your business, you’re also responsible for paying in federal and state

A Change to the Taxability of Unemployment

If you collected unemployment last year, you’re certainly not alone. The unemployment rate in Massachusetts climbed as high as 17.4% in June of last year.

College Expenses: What Deductions are Available & Who Gets Them?

There are three major credits and deductions available to those with higher education costs. Tuition and Fees Deduction American Opportunity Credit Lifetime Learner Credit

Business Banking Best Practices

I had coversation with a client recently focusing on the best way to structure his business banking. It’s a conversation I have a lot,

Student Loan Forgiveness Could Mean a Large Tax Bill

There has been a lot of talk surrounding the forgiveness of student loan debt. At the time of this post, student loan debt hovers

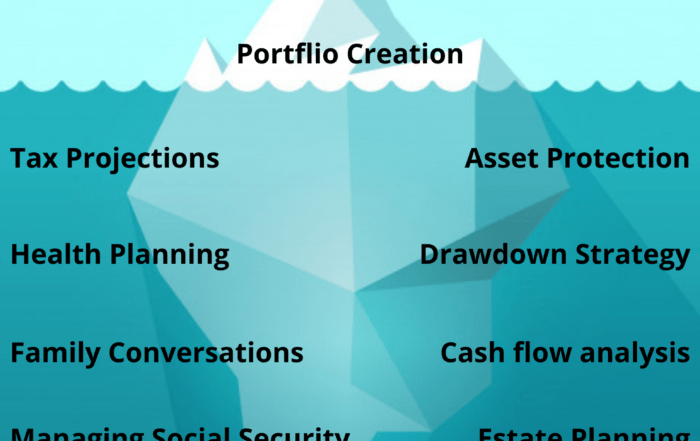

The Role of a Financial Advisor

Should Your Financial Advisor Be Doing More? When I ask people the role of a financial advisor and what their advisor should be

Reasons to be Optimistic and Pessimistic for the 2021 Market

What’s in store for the market in 2021? No one knows for sure. However, we can look at where things are now and what’s

Can You Take The Home Office Deduction?

This year has been different for many. For most, there has been a period of no work, or work from home status. I’ve heard

Second PPP Loan is Now Available

For businesses looking for help, another round of PPP is here. As of today, Monday November 11th, the application window has been opened for businesses

Helping to Pay Your Employee’s Student Loan Can Save Both of You Money

The Cares Act, passed back in March, allowed for employers to help pay their employee’s qualified student loans or tutition tax free to the employee.

Second Stimulus Package Underway

Congress has finally reached an agreement on a new financial aid package, which includes stimulus checks to many Americans. The total package in approximately $900

Second Stimulus Check Update

The latest on a second stimulus check looks promising for many. Based on the latest reports, it appears a check for $600 many be on

Year-End Tax Planning

We believe taxes are a year-round concern. Any major life changing event or financial decision can have tax consequences that should be addressed. Even something

President-Elect Biden’s Tax Proposal

As a local CPA firm in Plymouth, we find our role above and beyond tax preparation also involves tax planning and educating our clients. With the presidential

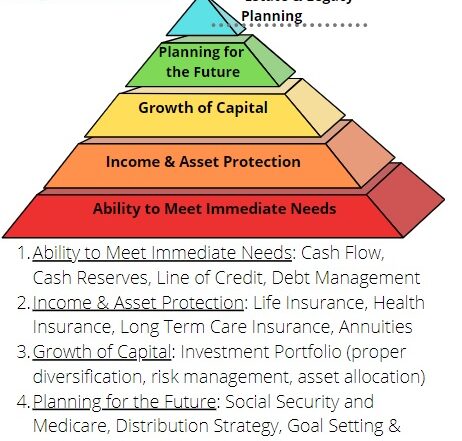

Financial Health & Success Pyramid

We designed this pyramid as a way to help clients visualize their financial health and the various pieces that make up the whole. It's simple, but

For High School Kids, Traditional Jobs May Not Be As Readily Available

Coronavirus has impacted many of us. The job landscape has changed. Some of it may be permanent. For high school aged kids, their job provides freedom;

Tax Preparation Vs. Tax Planning: The Great Debate

Tax Preparation vs. Tax Planning: The Great Debate Well not much of a debate, really. Although based on how I see most people handling their taxes,

5 Things Successful Retirees Do

Retiring When the Time is Right Too often, retirees solely focus on whether they have the appropriate amount in savings when making the decision to retire.

The Achilles Heal of ETFs in Your Portfolio

Exchange Traded Funds (ETFs) came on the scene in the 1990s and have since gained tremendous popularity. ETFS provide a way to gain access to passive

Don’t Get Burned on Taxes from Unemployment

Many people who have lost their jobs or saw their hours reduced due to the Covid pandemic have been receiving unemployment. In conjunction with state unemployment

Navigate a Possible COVID-19 Related 529 Education Plan Trap

Covid-19 has had a major impact on almost everyone’s life. Even daily tasks have been affected. I can’t tell you how many times I’ve left the

Will There be a Second Stimulus Package?

There has been talk of a possible second wave of stimulus checks or other form of financial relief for Americans during the Coronavirus pandemic and related

Make a Down Market Work For You

Okay, so your investment value took a hit in the recent market plummet. With a bull market that extended over ten years, hopefully this wasn’t a

Ways to Save During Covid-19

With people across the country practicing safe social distancing and doing their part by staying home, now is a great time to save some money. For

Should Millennials be Worried About Social Security

Unfortunately, I don’t have a quick answer to this. If I had to give one, it would be yes and no. Should millennials retiring in 25

Budgeting How To

If you read my article focusing on financial success in your twenties, you will already know how important I believe a proper budget to be. It

I’m Young. I Don’t Need A Financial Planner. Right?

Last week I got a phone call from a young client of mine who had a question on what to claim on his W4. He was

Coronavirus Financial Relief Options for Individuals and Businesses

There has been substantial legislation passed recently aiding those in need due to the recent COVID-19 outbreak. These bills/acts have had sweeping legislative changes. We have taken the time to comb through everything

What to Look for in an Accountant

There are a lot of accountants out there. Many of them have different credentials and backgrounds in education and experience. Navigating the sea of choices can

Choosing the Right Financial Planner

Choosing the right financial planner is a very important decision. Hopefully, your choice will lead to the start of a healthy relationship that will last a

Are you paying your child an allowance? Don’t! Do this instead.

We all know that giving children chores helps build character and instills a sense of responsibility. For those who can afford it, giving a modest allowance

When to Leave a 401(k) Plan

There are two scenarios when you may want to take control of your assets in your 401(k) plan. You leave your employer (either to retire or

Coronavirus: What it Means for Your Investments

For those watching the markets recently, a common question seems to be emerging. How much lower will the markets drop, and for how long, due to

Campbell Financial Services Announces Rebrand and New Website

Plymouth, MA: Tax planning and financial advising firm Campbell Financial Services has formally rebranded to reflect the recent growth in the organization as well as the firm’s commitment to provide a frictionless experience for clients with

How To Navigate a Possible Market Downturn

The market has been a bull market for over ten years now. Only two other times in history has the market maintained bull status for over seven

Traditional vs Roth: Which is right for me?

If you’re looking to fund an IRA, you might be wondering which type of IRA (Roth or Traditional) is the most appropriate choice. The chart below illustrates the

Top Four Deductions You Can Make Before the End of the Year

Want to know how you can reduce your tax liability this coming tax season? Take a look at the Top four Deductions that can still make a

Three Questions that Predict Future Quality of Life

MIT AgeLab has identified three simple questions you should ask yourself to assess how prepared you are to live well in retirement. What

To Itemize, or Not To Itemize?

The decision to itemize deductions has plagued taxpayers for almost 65 years. Each year, clients and tax professionals crunch numbers to determine whether the standard deduction or

Contact Us

Book an Appointment

- 1-508-747-5249

Sign up for our newsletter!

(We do not share your data with anybody, and only use it for its intended purpose)