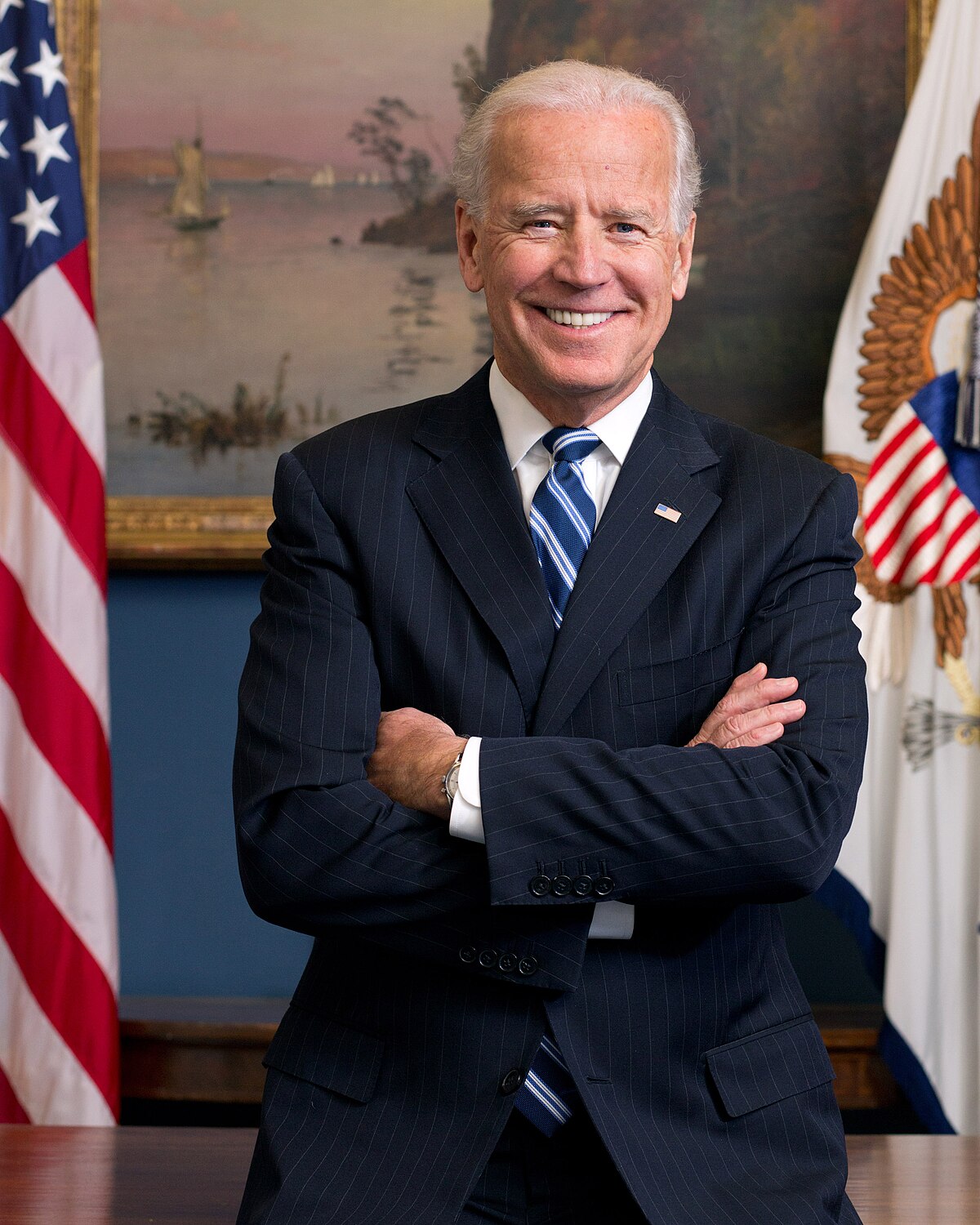

As a local CPA firm in Plymouth, we find our role above and beyond tax preparation also involves tax planning and educating our clients. With the presidential election behind us, we thought it would be beneficial to highlight President-Elect Joe Biden’s tax proposals. It’s important to note that these are just proposals at the moment. Any law changes would need to move through Congress, and at the moment, it appears the Republican Party will control the Senate. This may make some of these changes difficult to pass or result in modificiations to initial proposals. As always, we will keep updated on how things progress. For now, these are highlights of suggested updates to the tax laws by the Biden team:

1. Increase the top individual tax rate from 37% to 39.6% for those making over $400,000 Married Filing Joint

2. Increase payroll taxes: Currently, wages up to $137,700 are subject to social security tax. Social Security tax is 12.4 percent. Half of this is paid by the employer, and the other half by the employee/taxpayer. Biden plans to re-impose payroll taxes on wages in excess of $400,000, effectively creating a “donought hole” where wages between $137,700 and $400,000 would not be subject to social security taxes.

3. Increase capital gains taxes: Currently, long term capital gains are taxed at preferential rates of either 15% or 20%. Under Biden’s plan, those making over $1 million dollars would have capital gains subject to ordinary income rates, which would be 39.6%.

4. Expansion of the Child Care Credit: Currently, a childcare expense credit is available for qualified taxpayers who pay for daycare. It is limited to $3,000 per child, up to two children. Biden plans on expanding this to $8,000 per child, up to $16,000.

5. Increase the Child Tax Credit: from $2,000 to $3,000 per child and an additional $600 bonus for those with children under the age of 6.

6. Decrease the Estate Tax Exemption: from current levels of $11.58 million to 2009 levels of $3,500,000. Estate tax is a tax on decedent’s assets that exceed the exemption amount. Biden also wants to increase the estate tax rate to 45%. Currently it stands at 40%.

7. Provide a $15,000 credit for first time homebuyers

8. Eliminite the Qualified Business Income deductions for those making over$400,000

9. Eliminating the step-up in basis: Currently, when an individual dies, the heirs receive the property at a “stepped-up basis” equal to the current fair market value. Biden is looking to remove this provision, which would result in the inheritance being received at the original cost/purchase price. This means the heir will pay tax on the appreciated amount (the difference between the original cost and current fair market value) when the asset is sold.

10. Increase the corporate income tax rate from 21% to 28%

11. Cap itemized deductions: Currently, taxpayers choose between the standard deduction of $24,400 for married couples or itemizing deductions (whichever is greater). Biden’s tax proposal caps itemized deduction amount to 28% of adjusted gross income. Itemized deductions include medical expenses, state and local taxes, mortgage interest, casualty and theft losses, and charitable donations.

12. Expands the Earned Income Credit for seniors without children

13. Adjustments to the credits for contributions to retirement plans: Currently, contributions to traditional retirement accounts reduce taxable income by that amount. So, if you are in the 37% tax bracket, a $1,000 contribution to your 401(k) would reduce your taxes by $370. Biden’s team believes this is unfair for those in lower tax brackets. An individual in the 12% tax bracket making the same contribution amount of $1,000 would see a tax reduction of $120. To account for this, Biden is suggesting a flat credit of 26%. This, he believes, will level the playing field. Using the same examples, the first taxpayer would see their tax benefit reduced by $260 while the second would see a tax benefit increase of $140.

If you are looking for help understanding how these laws may impact you if they come to fruition, we are happy to help. As a tax preparation office in Plymouth, you will be able to speak with a CPA who can apply these possible changes to your unique situation through tax planning.

Contact Us

Book an Appointment

- 1-508-747-5249

Sign up for our newsletter!

(We do not share your data with anybody, and only use it for its intended purpose)

Leave A Comment